Personal Debt Collection - The Facts

Wiki Article

The Definitive Guide for Private Schools Debt Collection

Table of ContentsThe Ultimate Guide To Dental Debt CollectionFacts About Dental Debt Collection RevealedThe 6-Minute Rule for Debt Collection AgencyThe Dental Debt Collection IdeasA Biased View of International Debt Collection

Discover more about how to identify debt collection rip-offs. You can ask a collector to stop contacting you as well as dispute the financial obligation if you assume it's imprecise. If you perform in truth owe the debt, there are 3 basic methods to pay it off: consent to a settlement strategy, wipe it out with a solitary settlement or bargain a settlement.

The collector can not inform these individuals that you owe money. The collection firm can speak to another person just as soon as.

It can, yet does not need to approve a partial settlement strategy (Business Debt Collection). An enthusiast can ask that you create a post-dated check, but you can not be needed to do so. If you offer a debt collector a post-dated check, under government regulation the check can not be deposited prior to the date written on it

The most effective financial obligation collection agency task summaries are succinct yet compelling. Supply details about your firm's worths, objective, and also culture, and also allow candidates understand how they will contribute to business's development. Take into consideration using bulleted checklists to improve readability, consisting of no more than six bullets per area. Once you have a solid initial draft, assess it with the hiring supervisor to ensure all the info is exact and the requirements are strictly vital.

The Main Principles Of International Debt Collection

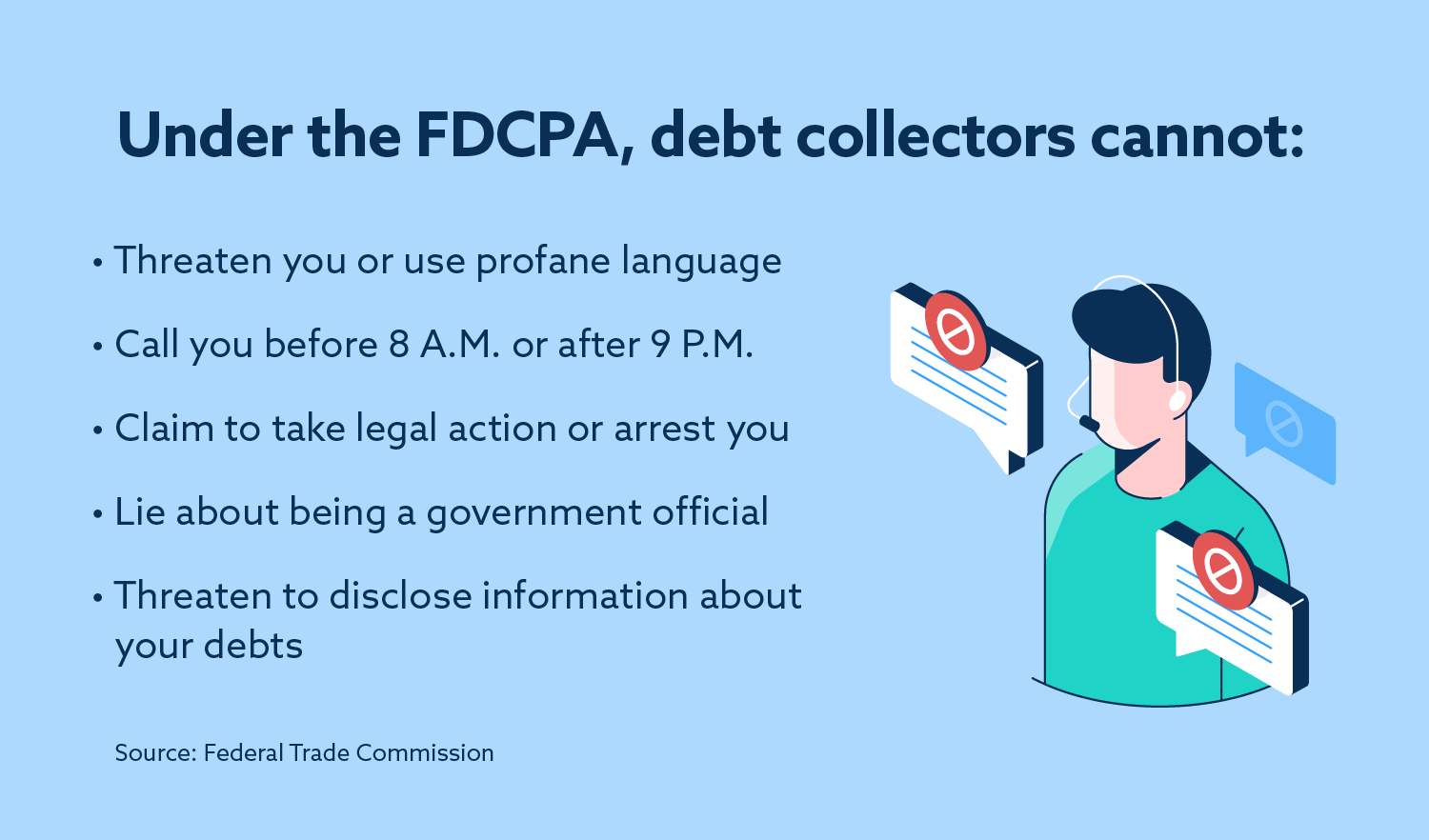

The Fair Debt Collection Practices Act (FDCPA) is a government legislation applied by the Federal Trade Payment that protects the rights of customers by prohibiting certain methods of financial debt collection. The FDCPA relates to the methods of debt collection agencies and attorneys. It does not apply to financial institutions that are trying to recoup their own debts.

The FDCPA does not use to all debts. It does not apply to the collection of service or corporate financial debts.

It is not meant to be lawful suggestions regarding your certain trouble or to replacement for the guidance of a lawyer.

:max_bytes(150000):strip_icc()/when-do-debt-collections-fall-off-your-credit-report-960584-Final-a5e292f44c64429a9290c7967ca77b79.png)

Examine This Report about Private Schools Debt Collection

Personal, household and home financial debts are covered under the Federal Fair Financial Debt Collection Act. This consists of money owed for treatment, revolving charge account or auto acquisitions. Business Debt Collection. A debt collector is anybody besides the financial institution who consistently accumulates or attempts to accumulate financial obligations that are owed to others which resulted from customer dealsWhen a financial obligation enthusiast has alerted you by phone, he or she must, within navigate to this website 5 days, send you a composed notification exposing the amount you owe, the name of the lender to whom you owe money, and also what to do if you contest the financial debt. A financial debt enthusiast may NOT: bug, oppress or abuse any individual (i.

You can quit a debt collection agency from calling you by writing a letter to the debt collection agency telling him or her to stop. As soon as the company receives your letter, it may not call you once again other than to alert you that some particular action will be taken. A financial debt collection agency may not contact you if, within 1 month after the collector's first contact, you send out the collector a letter specifying that you do not owe the cash.

The Private Schools Debt Collection Diaries

This product is offered in alternative layout upon request.

Rather, the lending institution could either employ a company that is hired to collect third-party financial obligations or sell the debt to a collection company. As soon as the financial obligation has been offered to a debt collection firm, you may begin to obtain phone calls and/or letters from that agency. The financial obligation collection market is greatly controlled, and also debtors have many civil liberties when it concerns dealing with expense collection agencies.

Regardless of next this, financial debt collection agencies will try everything in their power to obtain you to pay your old financial obligation. A debt enthusiast can be either an individual person or a company.

Financial obligation collection agencies are hired by financial institutions as well as are normally paid a portion of the amount of the financial debt they recover for the lender. The percentage a collection agency fees is normally based upon the age of the financial debt as well as the quantity of the debt. Older financial obligations or higher financial obligations may take more time to gather, so a debt collector may charge a higher portion for gathering those.

Some Known Incorrect Statements About Debt Collection Agency

Others deal with a contingency basis and just bill the creditor if they achieve success in collecting on the financial debt. The financial debt debt collector gets in into an agreement with the creditor to gather a percent of the financial obligation the percentage is stipulated by the creditor. One financial institution might not want to choose less than the full quantity owed, while one more could approve a settlement for 50% of the financial obligation.Report this wiki page